AE Industrial Partners Continues to Lead Sector Consolidation Among Financial Buyers

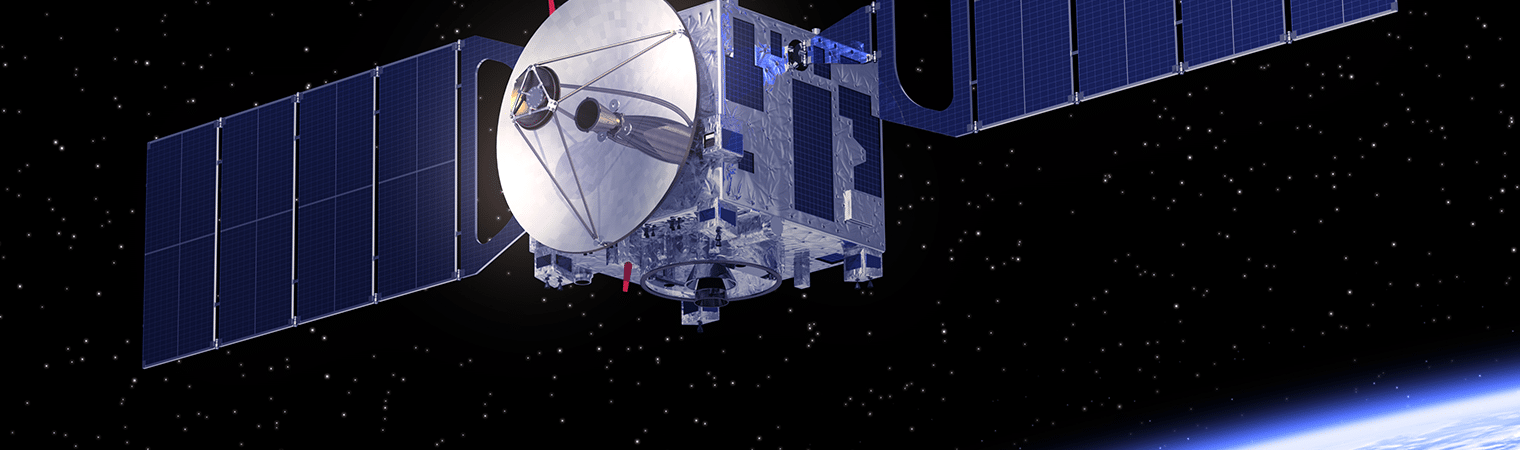

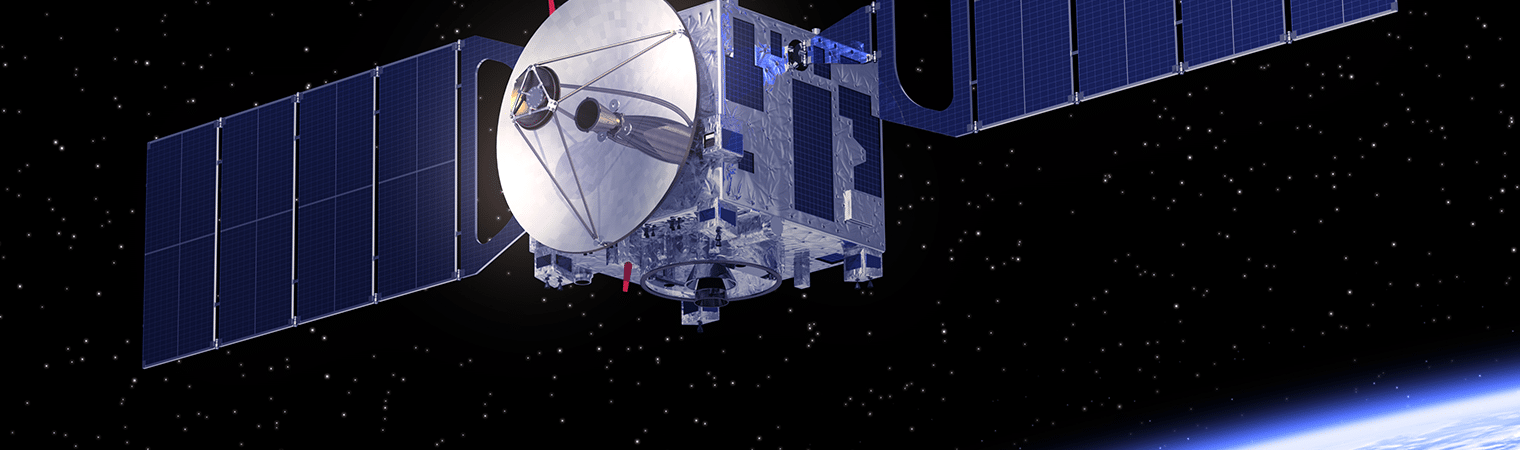

In the landscape of Air, Land, Sea, & Space (ALSS) Systems, AE Industrial Partners (AEI), headquartered in Florida, has emerged as a key player in acquisition activities. Particularly notable is AEI's significant involvement in the sector during June 2023, where the firm concluded four transactions within ALSS Systems. These transactions, either direct acquisitions or facilitated through its portfolio companies, collectively accounted for 10% of the total financial buyer activity in the sector for the year. One of AEI's portfolio companies, York Space Systems, stands out as a flagship entity in the Space Systems and Small Satellite (SmallSat) segments. York secured a substantial contract worth $615 million from the U.S. Space Development Agency (SDA) in October 2023. This contract is aimed at producing 62 satellites for the Department of Defense's (DOD) LEO constellation, positioning York as the primary supplier of satellites for the SDA.

AEI's involvement in the ALSS Systems sector is further underscored by its participation in significant transactions:

1. Acquisition of Spaceflight by AE Industrial Partners-backed Firefly Aerospace (June 2023, Undisclosed):

Firefly Aerospace, a company within AEI's portfolio, completed the acquisition of Washington-based Spaceflight in June 2023. Spaceflight specializes in offering launch and in-flight transportation services for satellites, along with providing various sub-systems. Following this acquisition, Firefly intends to exclusively utilize Spaceflight's services on its own vehicles.

2. Acquisition of the Remaining Assets of Virgin Orbit by AE Industrial Partners-backed Firefly Aerospace (June 2023, $3.8 Million):

During Virgin Orbit's Chapter 11 bankruptcy proceedings, Firefly Aerospace, backed by AEI, acquired the remaining assets of Virgin Orbit for $3.8 million. This strategic move provided Firefly with significant cost savings on common components and eliminated supply chain lead times. Notably, Firefly's collaboration with the U.S. Space Force for a record-breaking satellite launch, utilizing its Alpha launch vehicle, further solidified its position in the sector.

For a deeper dive into the prevailing trends influencing the Air and Space Systems segments or to receive tailored updates on your business, we invite you to engage with us further.